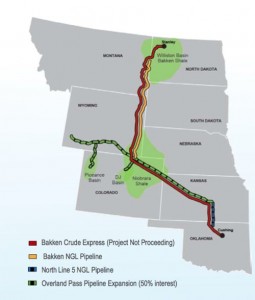

Oneok announced it is canceling plans to build the Bakken Crude Express pipeline after a binding open season ended without enough long-term volume commitments. The 1,300 mile pipeline would have delivered light-sweet Bakken crude to Cushing, OK. The pipeline had a proposed capacity of 200,000 bbls. Typically, midstream companies like to get firm commitments for at least 60% of a pipeline's capacity. That would suggest Oneok had commitments of less than 120,000 b/d.

"Despite the robust outlook for crude-oil supply growth in the Williston Basin in the Bakken Shale, we did not receive sufficient long-term commitments under the terms we needed to construct the Bakken Crude Express Pipeline," said Terry K. Spencer, ONEOK's president.

The cancellation comes as a surprise to some. The Bakken is setting new production records each month and some analysts expect production will ultimately reach 1.5-2 million barrels a day. For reference, the Bakken produced more than 660,000 bbls/d in September. That's a record, so why was there little interest in Oneok's pipeline? It probably has more to do with timing. The pipeline was set to deliver crude in Cushing, Oklahoma. Cushing is where WTI is priced.

If you follow the crude market, you've seen how depressed WTI oil prices are. As of Friday November 30th, WTI was trading at almost $89/bbl, while Brent, a comparable crude traded internationally, was trading at more than $111/bbl. That's a $22 difference for the same barrel of oil. Today, many Bakken operators are bypassing Cushing to realize better prices. Trains are flexible and railcars can reach areas where better prices are paid (i.e. Louisiana or the East Coast).

I suspect the Bakken Crude Express was the victim of bad timing. If there were ample pipeline capacity out of Cushing, there wouldn't be any worry about oversupply in the area. As projects come online in the next year, we'll see much of the pressure on WTI alleviated. When that happens, the Bakken Crude Express might be reborn.