Bakken Rigs

The Bakken-Three Forks rig count fell by two this week landing at 27 rigs running across our coverage area by midday Friday.

A total of 443 oil and gas rigs were running across the United States this week, which is a drop of seven over last week. 89 were targeting natural gas (one more than the previous week) and 354 were targeting oil in the U.S. (eight less than the previous week). The remainder were drilling service wells (e.g. disposal wells, injection wells, etc.) 27are in ND alone.

Bakken Oil & Gas Rigs

The Bakken oil rigs were at 27 this week with Bloomberg reporting WTI oil prices trading at $36.79 on Friday afternoon. WTI-Brent held steady at $41.94. The Bakken has zero natural active gas rig in the area this week with futures increasing to $1.99/mmbtu by midday.

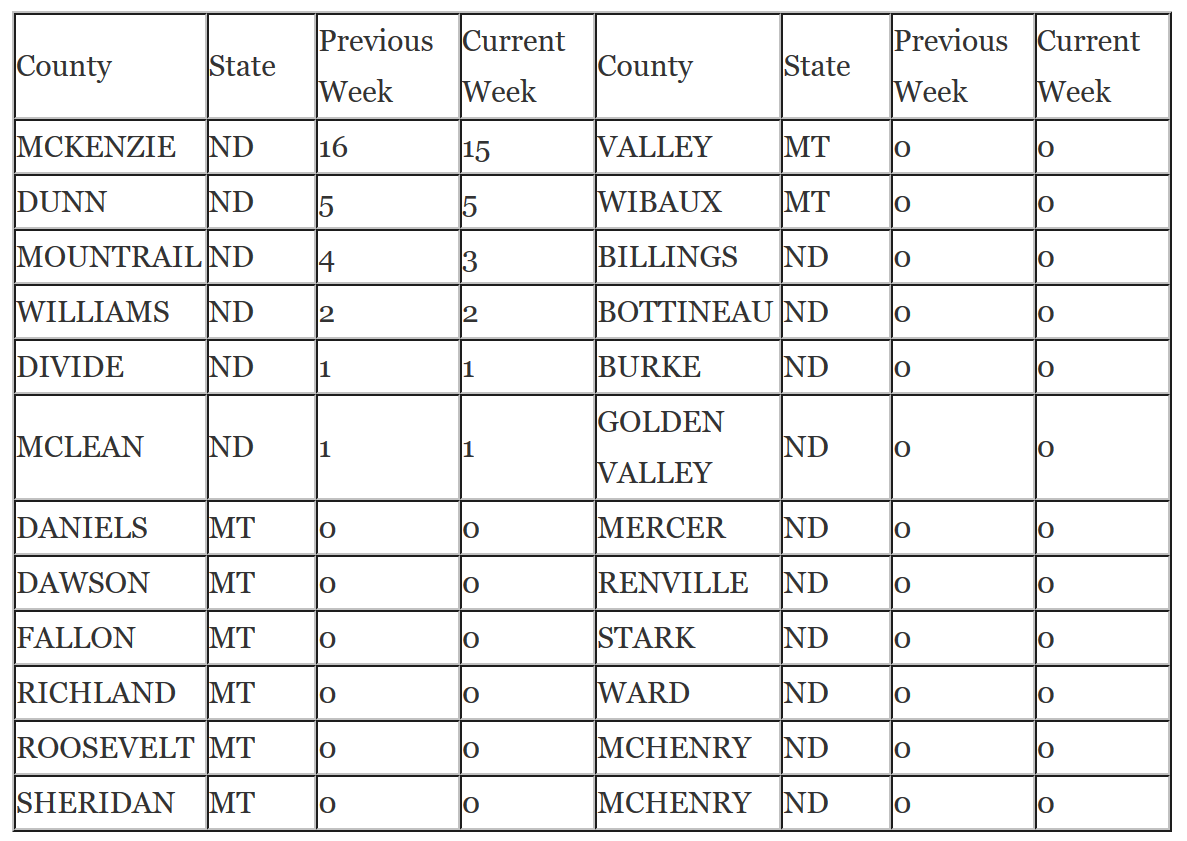

McKenzie County continues to lead development with 15 rigs running this week, far outpacing other counties. View the full list below under the Bakken Drilling by County section.

Activity continues to be dominated by horizontal drilling:

- 27 rigs are drilling horizontal wells

- 0 rigs are drilling directional wells

- 0 rigs are drilling vertical wells

Bakken Drilling by County

What is the Rig Count?

The Bakken Shale Rig Count is an index of the total number of oil & gas drilling rigs running across Montana and North Dakota. The rigs referred to in this article are for ALL drilling reported by Baker Hughes and not solely wells targeting the Bakken formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count.

Read more at bakerhughes.com