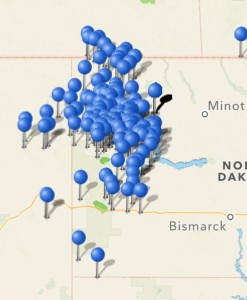

The Williston Basin rig count is up five rigs to 190 rigs running since the end of April.

Activity should be strong throughout the rest of the year.

News from this week was highlighted by our time at Bentek's annual Benposium Conference. We came away with several Bakken highlights.

One of those is that rail is likely here to stay. Oil will begin moving back onto pipelines, but it will be a dog fight and pipeline operators will have to offer competitive prices.

It was also noted that oil production has grown nearly twice as fast as many analyst predicted.

Natural gas prices were up a little to more than $4 again at $4.06/mmbtu on Friday afternoon. It has been a mild May, so having a $4 price and not a $2 price is a nice gift for natural gas producers.

WTI futures were almost unchanged from the past two weeks at $96/bbl on Friday afternoon. Williston Basin sweet crude traded at $83.69/bbl on May 17th.

Other Bakken related news from the past week includes: