The Bakken-Three Forks rig count decreased by one to 191 rigs running across our coverage area by the end of last week. The NDIC notes 194 rigs are active in North Dakota, but around 13 of those are in the process of moving in and rigging up.

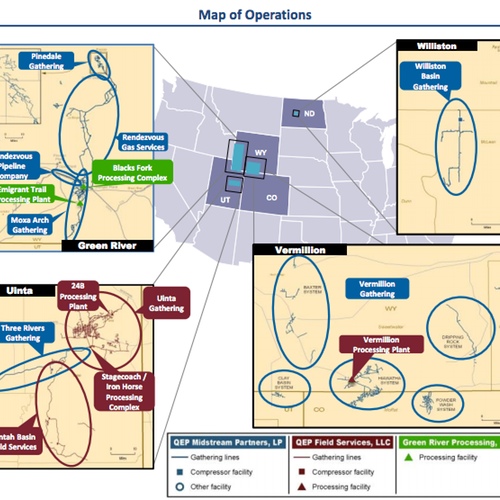

In recent Bakken news, San Antonio, TX-based Tesoro Logistics LP agreed to buy Denver, CO-based QEP Resources Inc.’s natural gas pipeline and processing business, QEP Field Services, for 2.5-billion in late October of 2014. The deal also includes a 58% ownership in QEP Midstream Partners.

The acquired assets operate over 2,000 miles of natural gas and crude oil gathering and transmission pipeline, with locations in North Dakota’s Bakken Shale and the Rocky Mountain region. The assets have have a combined 2.9 billion cf/d of natural gas and 54,000 b/d of crude oil throughput capacity.

Read more: Tesoro Buys QEP's Bakken Pipeline Assets - $2.5 Billion

The U.S. rig count increased by 9 to 1,927 rigs running by the end of last week. A total of 332 rigs were targeting natural gas (four more than the previous week) and 1,595 were targeting oil in the U.S. (5 more than the previous week). The remainder were drilling service wells (e.g. disposal wells, injection wells, etc.). 192 rigs are running in the Williston Basin across MT, ND, and SD. 180 are in ND alone.

Not all rigs counted in our census are drilling for the Bakken, but it's close. The NDIC estimates 95% or more of activity in this region targets the Bakken and Three Forks formations.

Note: The NDIC reports 194 rigs are active in North Dakota. That is two more than Baker Hughes reports in the Bakken area, and 14 more than the company reports in North Dakota. On any given week, a certain number of rigs are in route to the next well location or idle waiting to drill the next well. The NDIC notes that around 13 rigs are in the process of moving in and rigging up.

Bakken Oil & Gas Rigs

The number of oil rigs decreased by one to 191 rigs running by the end of the week . WTI oil prices decreased by ~$2.00 from the previous week, trading at $81.08/bbl on Friday afternoon. Williston Basin Sweet crude traded at $63.94/bbl on Oct. 16th. The WTI-Brent closed up a bit, settling at just underr $5 by the end of last week.

The natural gas rig count in the region held flat at zero. Natural gas futures (Henry Hub) were trading at $3.61/mmbtu by the end of last week. A little more than 10% of the production stream from the Bakken and Three Forks is attributable to natural gas and roughly half of that is NGLs.

McKenzie County continues to lead development with 62 rigs running. Mountrail, Williams and Dunn counties are the only other counties with more than 25 rigs running each. View the full list below under the Bakken Drilling by County section.

Activity is dominated by horizontal drilling:

- 174 rigs are drilling horizontal wells

- 13 rigs are drilling directional wells

- 4 rigs are drilling vertical wells

Bakken Oil & Gas News

Be sure to visit our Bakken Job Listings to search openings and come back weekly for updates or sign up for alerts - Daily or Weekly Email Alerts

What is the Rig Count?

The Bakken Shale Rig Count is an index of the total number of oil & gas drilling rigs running across Montana and North Dakota. The rigs referred to in this article are for ALL drilling reported by Baker Hughes and not solely wells targeting the Bakken formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count.