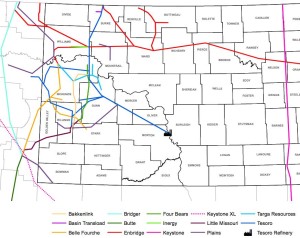

MDU Resources' WBI Energy plans to build a $650-700 million, 400-mile pipeline from the Bakken to markets in eastern North Dakota, Minnesota, and Wisconsin.

The pipeline will stretch from western North Dakota to western Minnesota and will tie into Viking Gas Transmission's pipeline system. The Viking system will allow gas to move into markets in Wisconsin.

“It`s exciting to think that the proposed pipeline could provide a new transportation route to bring Bakken-produced natural gas directly to industrial customers and commercial and residential utility customers in eastern North Dakota,” said David L. Goodin, CEO of MDU Resources. “Through interconnecting pipelines, the proposed pipeline could also serve Minnesota, Wisconsin and Midwest U.S. markets.”

Planned capacity is 400 mmcfd, but it could be expanded to 500 mmcfd if user commitments warrant the change. The pipeline will include 400 miles of 24-inch pipe, at an estimated construction cost of $650-700 million.

Steven L. Bietz, president and CEO of WBI Energy. "This project would be the largest single pipeline construction project in our company history. This project, combined with other recent and ongoing projects, would bring our total Bakken-related investment to nearly $1 billion."

An open season for the pipeline will start late this summer and construction is expected to start in early 2016.