Summit Midstream has agreed to buy Bison Midstream, LLC, for $250 million.

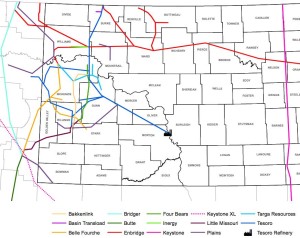

Bison Midstream owns a natural gas gathering system that includes 300 miles of low and high pressure gathering lines, as well as six compressor stations (5,950 hp) in Burke and Montrail counties.

New compression is being added and capacity should grow from 20 mmcfd to 30 mmcfd by year-end 2013. A total of $40 million is being spent to improve the system in 2013 ($29 million remaining).

The Bison system is supported by producer commitments from over 675,000 acres and fee based agreements are in place for >$155 million in revenue through 2020. Additional agreements are currently being negotiated.

Steve Newby, CEO commented, "We are very excited about the acquisition of Bison, our first drop down transaction from Summit Investments"

The system includes 229 miles of polyethylene pipe for low-pressure gathering and 70 miles of high pressure steel pipe.

If I deciphered the information on the company's website correctly: Bison Midstream was owned by Summit Investments, who is owned by members of Summit Midstream's management, Energy Capital Partners, and GE Energy Financial Services.

The deal was announced in conjunction with a $210 million acquisition in the Marcellus Shale.

Read the full press release at summitmidstream.com