Several key leaders from across the industry shared their optimism at the annual Deloitte Oil & Gas Conference on November 16th.

The conference agenda covers the global oil & gas industry, but US shale plays dominated the conference. Many of the speakers reiterated that we're no longer in a "shale revolution", but a renaissance that will last for years to come.

The industry is focused on innovation. New technologies are needed to address challenges presented in shale development. Whether it is lowering operating costs or utilizing currently flared gas through a gas-to-liquids (GTL) process, the industry sees room for growth.

A few key points and statistics we noted while at the conference:

- Oil production has grown to 1980s levels

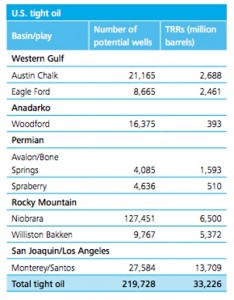

- 15% of technically recoverable shale gas and 17% of technically recoverable shale oil resources globally are located in the US

- The US will pass Russia as leading O&G producer this year; will pass Saudi Arabia next year

- Shale has increased our current trade balance by $200 million/yr and is predicted to give us oil independence by 2020

- US has increasing geopolitical influence in critical regions due to growing oil & gas production

- The oil export ban needs reform. Otherwise, refinery changes are needed and we will consume more expensive crude.

- Operators are focused on cutting costs to increase valuations

- According to Maynard Holt, "we may be in the 8th inning of the shale game, but we're in the 3rd inning of the completion/cocktail game"

- Since 2008, foreign firms have invested over $100 billion in US unconventional assets

- Over that period, Chinese companies have spent $44 billion to acquire N. America based energy firms and assets

- Gas-to-liquids technology is becoming more and more attractive with current oil and gas prices

- Skip Horvath, Natural Gas Supply Association predicts that natural gas will hit $6.00 by 2020, "assuming Washington leaves us alone over the next few years."

"This boom isn't just for a few years. We believe the shale revolution really has staying power" -Ryan Lance, ConocoPhillips CEO

About the Deloitte Oil & Gas Conference

The Deloitte Oil & Gas Conference is an annual conference for oil and gas executives and leading industry experts to share their views on important issues facing the global oil and gas industry. The objective of this conference is to provide a forum for executives and managers from companies in all sectors of the oil and gas industry, commercial and investment bankers, industry analysts, service providers to the oil and gas industry, representatives of government agencies, trade groups and policy planners, to understand emerging issues.