Throughout 2014, the energy market experienced unprecedented production along with wildly fluctuating prices in crude, leaving many to wonder about the long-range future of the Bakken Shale region.

The North Dakota legislature recently commissioned a massive study from KLJ, Inc. to analyze the economic forecast and possible trends for 19 counties through the year 2019. This unprecedented study concentrated on areas such as population growth, employment, housing.

The oil boom means more job opportunities in companies directly involved in oil and gas production as well as in industries that indirectly support this production. The study predicts that these jobs will spur a population increase in some North Dakota counties of more than 30%, a staggering number compared to the national average of 1.5%. This increase will add a strain on the already overtaxed housing market in the area, where a great deal of permanent housing has been depleted. In even the most modest scenario, the study anticipates that housing needs will increase by close to 30,000 units for the Minot, Dickenson and Williston regions. This may play a factor in the population projection as workers will have to make hard decisions about whether to bring family along as they move to the area for work.

“Permanent population will be largely driven by the supply of permanent housing in the region,” the study says. “Due to a lack of housing, the region will continue to have a total (service) population that is substantially larger than the permanent population measured by the U.S. Census.”

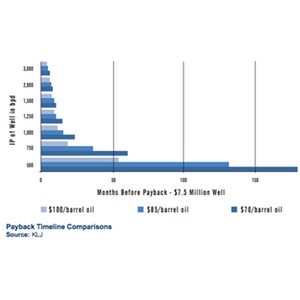

KLJ’s study was completed before oil prices began to drop sharply. Analysts will watch closely to see if falling prices affect the accuracy of this forecast.