The Senate will vote today on a bill to approve the Keystone XL Pipeline, after the House voted to approve it last Friday. The controversial pipeline would carry heavy oil sands crude from Canada and lighter Bakken crude to the Gulf Coast refining market.

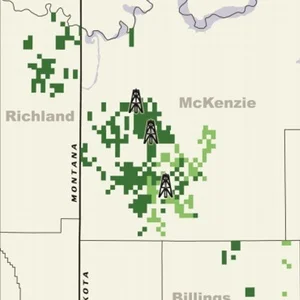

In 2013, the Congressional Research Service released a report that stated 12% of the Keystone XL Pipeline's 830,000 b/d ultimate capacity has been set aside for the transport of Bakken Crude. The report further said the Keystone XL pipeline project would include a lateral pipeline, called the Bakken Marketlink, to carry oil from Baker, MT, to the hub in Cushing, OK.

Although the Keystone XL Pipeline would play a role in the Bakken, its significance in the region has diminished slightly over time. Despite a still lacking midstream infrastructure in the Bakken, several pipeline projects have advanced as the political thunderstorm has ensued surrounding the Keystone XL Pipeline.

In September of 2013, Harold Hamm, CEO of Continental Resources, the Bakken's second largest producer, said the Keystone XL pipeline was no longer critical in an interview with Amy Harder from the National Journal. For full disclosure, at the time of the interview, Hamm's Hiland Partners was pushing its Double H Pipeline, a 460-mile pipeline project from Dore, ND, to Guernsey, WY., which is slated to be online by January of 2015.

Read more:No Need for Keystone XL - Continental's CEO Harold Hamm

Political Sway for the Keystone XL Pipeline

Senator John Hoeven (R-ND) is the Senate bill's chief sponsor. Hoeven has pushed for the pipeline for several years, and touts its benefits (i.e. an increase in jobs, energy security and a decrease in crude by rail transport).

“The Keystone XL pipeline is about energy, jobs, helping to grow our economy and increasing national security by increasing energy security,” Hoeven said in a prepared statement.”

Keystone Pipeline Could Alleviate Rail Congestion from Bakken Crude

Currently, just under 70% of all the oil produced in North Dakota, where much of the Bakken's development is concentrated, is transported out of the state by rail, ultimately making its way for now to refining markets, primarily on the East and West Coasts. The Keystone XL Pipeline could alleviate some of the rail congestion being caused by the transport of oil, which would free up the rail service in North Dakota and across the midwest for the transport of other goods, primarily agricultural.