Houston, TX-based Magnum Hunter Resources has sold a large chunk of its Bakken acreage for $84.7-million to an undisclosed buyer.

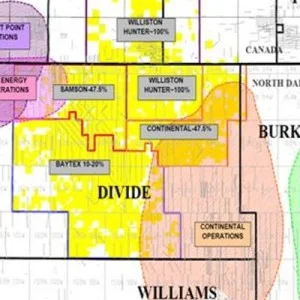

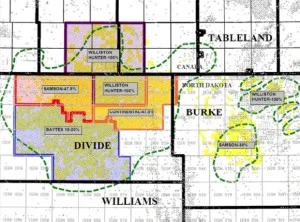

The deal, which closed in mid October of this year, included non-operated working interests in ~105,661 gross (12,500 net) leasehold acres in Divide County, ND. The divested properties currently account for net average production of ~720 boe/d.

“In a prepared statement, CEO Gary Evans described the sold Bakken assets as non-core. “Our remaining portfolio of assets located in North Dakota consists of 151 gross producing wells covering approximately 159,916 gross (73,690 net) acres, said Evans. Total net production to the Company from these remaining assets is currently approximately 2,577 boe/d at present with another ~800 boe/d anticipated to be put on production prior to year-end from this region.”

According to company officials, total divestitures, including this one, have amounted to $210-million across Magnum Hunter's portfolio so far in 2014. In the second quarter of 2013, the company sold 19,000 net acres in the Eagle Ford to Penn Virginia for approximately $400-million. The deal was for the majority of the company’s Eagle Ford holdings.

Read more: Magnum Hunter Resources Completes Sale to PVA - Still Targeting Eagle Ford & Pearsall

Magnum Hunter's divestment strategy is designed to shift the company's focus to growth in the Marcellus Shale and Utica Shale in West Virginia and Ohio.