Marathon is continuing to ramp up its presence in US domestic shale plays, with increased activity expected in the Bakken Shale through the end of 2014. In a company statement in late March 2014, officials revealed that Marathon hit its target of a 28-rig program across the Eagle Ford, Bakken and Oklahoma-Woodford Shale plays at the end of January.

Read more: Marathon Oil's Bakken Production Drives North American E&P Segment Income Up 38%

“Marathon Oil’s CEO Lee Tillman said, “We continue to have high confidence in our ability to deliver on our North America long-term production growth targets underpinned by strong resource growth through downspacing and well optimization. In addition, we are progressing the evaluation and appraisal of co-development opportunities with the Eagle Ford’s Austin Chalk and the Bakken’s deeper Three Forks benches.”

Marathon Bakken Operations Update

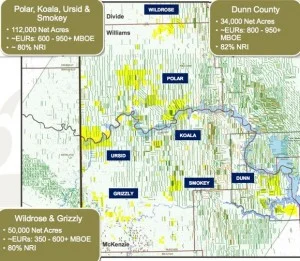

According to Marathon, the company's Bakken acreage accounts for ~800 mmboe in proven and probable reserves and resource potential. As of March 2014, Marathon had a 6-rig drilling program, and anticipates 75 - 85 net wells across the play in 2014. The company also expects to complete 20 - 24 net wells by the end of the year. The Bakken budget for 2014 remains at approximately $1 billion and 29% of the company' 2014 capital budget.

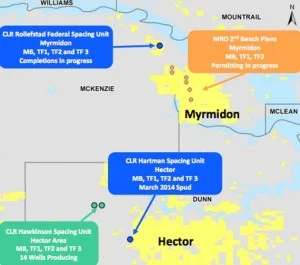

Marathon Targeting Deeper Three Forks Benches in Myrmidon Area

The Three Forks First Bench accounts for ~23% of proven and probable reserves. 45 gross operated wells are planned for the Three Forks in 2014. Six wells are planned in the lower benches of the Three Forks between 2014 - 2015. The initial focus will be on the Myrmidon area.

Read more at marathonoil.com