Marathon Oil announced further cuts to its 2015 capital spending plan, reducing numbers another 20 percent from their initial December forecast. This represents a total capex that is less than half of last year’s budget. The company will continue to focus spending on its shale resources and will reduce exploration spending by more than half.

Bakken Highlights

Marathon reports that its Bakken production increased 38% from 2013. This number includes 17 gross operated Bakken wells to sales, with 15 piloted enhanced completions. 18 pilot completion wells averaging greater than 30% uplift in cumulative production over the first 60 days. For 2015, Marathon’s operations in the Bakken will receive a $760 million piece of the pie, which represents 22% of the company’s total budget and includes approximately $550 million for drilling, completions and recompletions.

“President and CEO Lee Tillman noted that “Nearly 70 percent of our 2015 capital spending will be directed toward our three core U.S. resource plays, which continue to be among our highest-return investment opportunities. This budget reflects an emphasis on investment selectivity, balance sheet flexibility and positioning for price recovery.” He added, “Though our U.S. resource plays generate competitive returns at current pricing, we’re taking action to materially reduce our 2015 capital program relative to 2014 to protect our financial flexibility.”

Marathon in the Bakken Formation

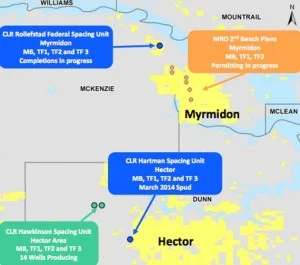

The North Dakota Bakken Shale oil play is top investment priority for Marathon Oil, where they have approximately 370,000 acres across North Dakota and Montana.

Marathon News: Energy Giants Announce Layoffs

Read more at marathonoil.com