U.S. Energy Corp. and Abraxas Petroleum released operational updates this week in the Bakken. The two companies interests are not connected.

U.S. Energy Corp. and Abraxas Petroleum are also active in the Eagle Ford Shale play in South Texas.

Read more: U.S. Energy Corp Provides Operations Update for Buda Limestone Wells

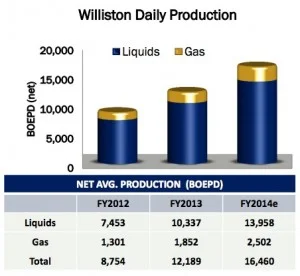

Abraxas Petroleum Williston Basin Operations Update

Abraxas is active in McKenzie County, ND. The company's Jore 1H, 2H and 4H are scheduled for fracking, following the completion of an Eagle Ford well. Abraxas owns a working interest of 76% in these wells.

On Abraxas' first Middle Bakken downspacing test, Raven Rig #1 successfully drilled and cased the surface and intermediate sections of the Ravin 6H and Ravin 7H. The company is now drilling the intermediate sections of the Ravin 5H, which will be followed by the intermediate section of the Ravin 4H. Abraxas owns a working interest of 51% in its' Ravin West pads.

“Bob Watson, CEO of Abraxas, said in a company statement,”in the Bakken, weather has abated and we plan to be on location in the coming weeks to frac our three well Jore pad. Drilling continues to run quite smoothly on the Ravin pad. Success on this initial downspacing test obviously carries with it significant reserve and inventory implications for the company.”

U.S. Energy Corp. Williston Basin Operations Update

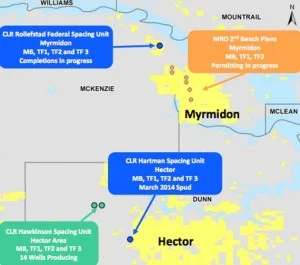

U.S. Energy Corp. has interests across 84,480 gross (3,225 net) acres in Williams, McKenzie and Mountrail Counties, North Dakota. At the end of 2013, the company had participation in 101 gross (10.7 net) Bakken and Three Forks formation producing wells. Due primarily to weather-related issues in North Dakota, the company's Williston Basin production decreased by ~24% during the first two months of 2014 to an average of ~ 625 boe/d as compared to 817 boe/d in the fourth-quarter of 2013.

Read more at abraxaspetroleum.com

Read more at usnrg.com