As the free-fall in crude prices continues, major Bakken operators are expressing their caution by slashing their budgets for 2015.

Marathon Oil is the latest giant to announce that its projected budget will curb exploration spending by a whopping 20% for 2015. Though the company still forecasts spending in upwards of $4.4 billion, the decrease is another sign that the spiraling oil prices are casting a dark shadow over the incredible growth that is taking place in the shale regions.

“We remain confident in our investment opportunities in the three U.S. resource plays,” Marathon Oil President and Chief Executive Officer Lee Tillman said in a statement. “Our 2015 capital program is not opportunity constrained but will reflect sound discipline in managing cash flows in the current price environment.”

Related: Eagle Ford and Bakken Drilling Permits Fall 30%

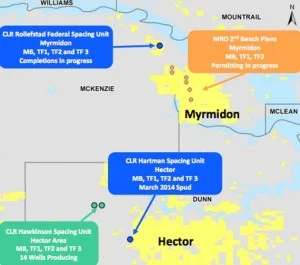

This news comes as oil plunged Thursday to an incredible $54.11, prices not seen since 2009. And Marathon is not the only E&P company to back off on growth plans. ConocoPhillips is also shaving 20% off for 2015, by deferring investment in unconventional plays. The company, however, is continuing to affirm its commitment to Bakken region, which continues to be a major source of growth for the company. Bakken’s largest operator, Continental Resources, also seems to be getting skittish as it announced Wednesday it will reduce spending in 2015 by $600 million and delay new rig starts while they wait out the current situation.