Abraxas Petroleum announced a record 2014 during its earnings call on March 4th and reported on their 2015 spending plan.

2014 Highlights include oil production that averaged 5,720 Boepd and $63.3 million in net income. Abraxas’ fourth quarter net income was $30.1 million, which is up over the same period in 2013 when they reported $27.0 million. The company’s adjusted net income for Q4 was $6.1 million, compared to $1.4 million in 2013.

Related: EOG Reduces 2015 Capex 40 Percent

Abraxas plans to cut its capital spending to $54 million for 2015, compared with $193 million in 2014. The company further expects a 26% growth in production to 7100 barrels a day as it completes the nine wells it drilled during 2014.

“Bob Watson, Abraxas’ President and CEO commented, “After a tremendous 2014 for Abraxas, we now enter a very tumultuous 2015 from a commodity price perspective. We remain focused on preserving our abundant liquidity and strong balance sheet, which we endeavor to use to our advantage in a distressed environment. We are also blessed with an attractive asset base that presents numerous opportunities to expand our capital program should commodity prices and service costs dictate. We look forward to updating the market on the results of some of these efforts in the near future.”

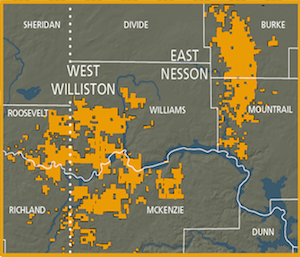

Abraxas’ operations in North Dakota spans has roughly 5,000 net acres in the Bakken, mostly in McKenzie County. The company announced that it recently drilled four wells to about 21,000 feet each on their Jore Federal West pad in record time and at a low cost. The company will defer completion on these wells as they wait for better weather and for production costs to decrease.

Find out more at abraxaspetroleum.com

Read the full call transcript at seekingalpha.com