Whiting Petroleum announces solid first quarter results for Bakken region.

In its Q1 press release, Whiting reported production totaling 15.0 million barrels of oil equivalent (MMBOE), 88% crude oil/natural gas liquids (NGLs). Production averaged 166,930 barrels of oil equivalent per day (BOE/d), a 3% increase over the fourth quarter 2014.

Whiting’s budget remains at $2 billion with capital expenditures expected to decline sharply in the second half of 2015.

“James J. Volker, Whiting’s Chairman, President and CEO, commented, “While we are reducing rig count and well cost, production was strong in Q1 2015. We had solid results in the Bakken/Three Forks and Niobrara. Our total rig count will average 11 rigs in the second half of 2015. Nine of these rigs will operate in the Bakken/Three Forks.”

Related: Whiting to Reduce Bakken Rig Count

Bakken Highlights

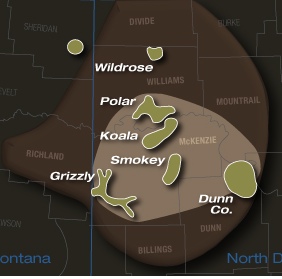

Whiting currently holds an astounding 1,270,092 gross acres in the Williston Basin of North Dakota and Montana. Here are Bakken In the first quarter 2015:

- Production from the Bakken/Three Forks averaged a record 133,500 BOE/d, an increase of 82% over the 73,325 BOE/d in the first quarter 2014

- The Bakken/Three Forks represented 80% of Whiting’s total first quarter production.

- As of December 31, 2014, Whiting had an estimated 7,541 future gross drilling locations in the Bakken/Three Forks formations, of which approximately 60% target the Bakken formation.

- At Dunn field in Dunn County, North Dakota, initial production rates from four Whiting-operated wells completed in mid-January averaged 3,181 BOE/d per well while 30-day rates averaged 1,255 BOE/d per well.

- At the Polar field in Williams County, North Dakota, initial production rates from four Whiting-operated wells completed in late February averaged 2,630 BOE/d per well while 30-day rates averaged 1,130 BOE/d per well.

- At the Koala field, which is located near our Hidden Bench field in McKenzie County, North Dakota, we completed four pad wells in mid-March that flowed an average rate of 2,584 BOE/d per well while 30-day rates averaged 1,395 BOE/d per well.

Read more at whiting.com