Whiting Petroleum announced on July 13, 2014, that it would acquire Kodiak Oil & Gas, in an all stock transaction, for $3.8 billion. The deal makes the combined company the largest Bakken/Three Forks producer, unseating Harold Hamm's Continental Resources from the top spot.

Next to the Eagle Ford Shale in South Texas, the Bakken Shale is the most prolific shale play in the world, with daily oil production exceeding 1-million b/d. With Whiting's acquisition of Kodiak, the company is positioning itself to be an even more formidable force in the Bakken.

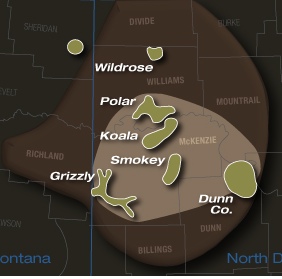

In the first-quarter of 2014, Whiting and Kodiak had combined production of 107,000 boe/d, and officials indicate total 2014 production will be 152,000 boe/d. The combined company has 855,000 net acres and an inventory of 3,460 net drilling locations.

“The addition of Kodiak’s complementary acreage position (approx. 173,000 net acres) and substantial inventory of high return drilling locations will provide the opportunity to drive significant value growth for both Whiting and Kodiak shareholders through an acceleration in drilling and increase in operational efficiencies,” said Whiting CEO James Voulkner.”

Whiting officials said the deal is valued at $6 billion when Kodiak's net debt of $2.2 billion is absorbed.

Kodiak shareholders will receive 0.177 share of Whiting stock in exchange for each of Kodiak common stock they hold, representing a value of $13.90 per share based on the closing price of Whiting shares on July 11, 2014.

The transaction is expected to close in the fourth quarter of 2014.

Read more at whiting.com