For the first time since the Energy Information Administration (EIA) began tracking drilling productivity, the agency reported on Monday that oil and gas production will decrease for the Bakken and other shale formations across the country.

Shale production has been a major player in boosting US output to more that 4 million bpd and has played a key role in the collapse of oil prices worldwide in 2014.

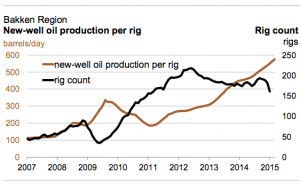

Production from the Bakken formation has increased 28% year-over-year despite declining rig counts across the area.

Related: Record Production for Bakken

The EIA estimates that the Bakken will experience a decline of 23,000 barrels of oil a day to 1.3 million in May. Natural gas will also decline by 21 million cubit feet per day.

“Speaking with Bloomberg, Carl Larry, head of oil and gas for Frost & Sullivan LP said, “We’re going off an inevitable cliff because of the shrinking rig counts. The question is how fast is the decline going to go. If it’s fast, if it’s steep, there could be a big jump in the market.”

Read more at eia.gov