The Energy Information Administration ( EIA) is predicting that oil production in the Bakken will begin to decline in June.

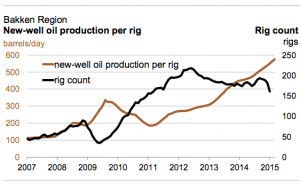

Shale producers have been reducing rigs, cutting budgets and laying off workers for months to compensate for low crude prices. Over the past year, the Bakken rig count has dropped by more than half, but until now production has remained at record levels, with the EIA reported 1.2 million barrels a day in February.

Related: Record Production for Bakken

In the EIA’s monthly productivity report for May, the agency reports that oil and gas production has probably peaked and they expect a 31,000 Mbbl/d drop in oil and 30,000 MMcf/d f drop for natural gas throughout June.

The Bakken had 80 oil rigs running last week zero gas rigs. WTI oil prices continued to climb trading at $59.39/bbl on Friday afternoon, a $.63 increase from the previous week and gas futures trading increased to $2.88/mmbtu.

Read more at eia.gov