Rumors have been swirling for weeks that Denver-based Whiting Petroleum might be up for sale and some companies may be biting.

Bloomberg reported on Friday that several companies are expressing interest in Whiting including Exxon Mobil Corp., Continental Resources Inc., Hess Corp. and Statoil ASA.

No one is talking openly about a possible deal including Whiting, who has not given any official statement about their intentions. All information has come from anonymous sources and people who are speculating about what the company may do.

“Bloomberg quotes Phillip Jungwirth, an analyst with Bank of Montreal, who says that “Whiting is probably exploring a sale along with other strategic alternatives, including selling assets, raising debt and selling shares in order to address investor liquidity concerns.”

Some believe that a full sale is unlikely due to the Whiting's heavy debt and that it is more probably that the company will sell off large pieces instead.

In early March, Whiting released its 2014 earning results with CEO James J. Volker boasting a strong year with record production and a string 2015 growth plan. A week later, rumors started to surface the Whiting was looking around for other opportunities.

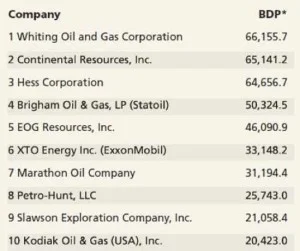

Whiting was founded in 1980 and became the largest Bakken/Three Forks producer in the Williston Basin after its acquisition of Kodiak Oil & Gas in June of last year.