Bakken oil is produced at a high quality that makes it easier to refine into commercial products and makes it easier to ignite.

There is nothing new about oil being flammable. The science has been the same for well....forever. At a point a few decades ago, light-sweet crude (WTI) was the dominate oil quality in the U.S.

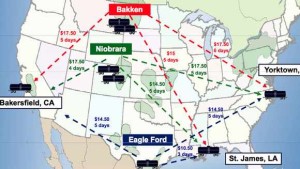

Light oil production growth in the Bakken, Eagle Ford, and Permian isn't something the industry has never seen or handled, but it is an unforeseen boom bigger than anyone expected.

Now that trains are moving the oil on a larger scale, it's important the terminals and rail companies meet high standards to ensure safety.

The flash point or lowest possible temperature at which the oil can be ignited is lower for Bakken oil than it is for tar sands coming out of Canada. That fact led the DOT to issue a Bakken Shale Oil Shipping Safety Alert last week.

What's Important to Ensuring Safety in the Bakken?

In short, the answer is YES. Bakken crude is of high quality and more flammable than lower grade crude oil, but that's nothing new and shouldn't be a shock. Emphasis needs to be placed on classifying the crude correctly (which it hasn't been shown that there is a problem there) and making sure the railroads are as safe as possible.

Additional safety measures need to be taken when hydrogen-sulfide or other flammable gases are dissolved in the oil. The oil needs to be degasified before transportation.

The other thing we can do as voters - Make sure pipelines can be built where needed without undue obstacles. The track record speaks for itself - pipelines are the safest and most efficient way to move hydrocarbons.

Please share your thoughts, comments, or questions below: