Mangnum Hunter Resources participated in bringing on 19 gross (5.5 net) Bakken wells in the second quarter of 2013. At the end of the quarter 20.4 gross (11.4 net) wells were in some stage of drilling or being completed.

Magnum Hunter also noted midstream delays brought on by wet weather. A Oneok gathering system expected to be online in April did not accept gas until the last week of June. The gas gathering system is being built in an effort to conserve natural gas production in the area. In total, the project will connect ~300 wells in the area over the next year.

Bakken & Three Forks Well Highlights

- Border Farms 3130-5TFH - (28.3% interest) Drilled to a measured depth of 14,300 ft (lateral length of 6,075 ft), fraced with 26 stages. The 24-hour flowing initial production (IP) rate was 626 boe/d

- Montclair 0112-2TFH - (16.7% interest) Drilled to a measured depth of 17,710 ft (lateral length of 9,572 ft), fraced with 40 stages and placed. The 24-hour flowing IP rate was 683 boe/d

- J. Olson 22-15-162-98H 2DM - (36.25% interest) Drilled to a measured depth of 18,215 ft (lateral length of 9,455 ft), fraced with 36 stages. The 24-hour flowing IP rate was 872 boe/d

- J. Olson 27-34-162-98H 2XM - (35.7% interest) Drilled to a measured depth of 18,842 ft (length of 10,096 ft), fraced with 36 stages. The 24-hour flowing IP rate was 820 boe/d

- Baja 2215-2H - (30.4% interest) Drilled to a measured depth of 18,155 ft (lateral length of 9,568 ft), fraced with 25 stages. The 24-hour flowing IP rate was 813 boe/d

- Baja 2215-3H - (30.4% interest) Drilled to a measured depth of 18,280 ft (lateral length of 9,820 ft), fraced with 25 stages. The 24-hour flowing IP rate was 1,076 boe/d

- Baja 2215-1H - (30.4% interest) Drilled to a measured depth of 17,977 ft (lateral length of 9,545 ft), fraced with 25 stages. The 24-hour flowing IP rate was 913 boe/d

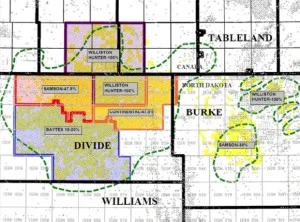

Magnum Hunter controls 190,000 net acres in the Williston Basin. 140,000 acres are located in North Dakota and ~50,000 acres are located in Canada.