Oasis Petroleum announced 2014 results and rolled out updated projections for the new year.

The company increased its net income by 122% from $228.0 million in 2013 to $506.9 million in 2014 and ended the the year with $45.8 million of cash and cash equivalents.

Other 2014 highlights include:

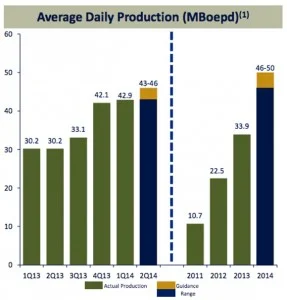

- Increased average daily production 35% from 2013 to 45,656 Boepd

- Q4 2014 average daily production of 50,143 Boepd

- Completed and placed on production 195 gross operated wells during 2014

- Increased total estimated net proved oil and natural gas reserves by 24%

Related: EOG Reduces 2015 Capex 40 Percent

Related: Marathon Oil Reduces 2015 Spending by Half

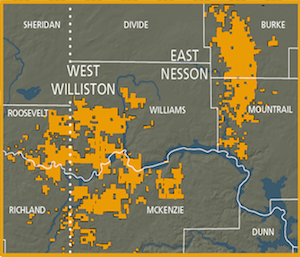

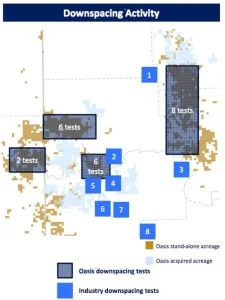

Bakken Highlights

The following table describes the Company's producing Bakken and TFS wells by project area in the Williston Basin as of December 31, 2014.

“Thomas B. Nusz, Oasis’ Chairman and CEO commented, “Capitalizing on our premier position in the Williston Basin, we have grown volumes by over 35% in 2014, including production in the fourth quarter of 2014 of 50,143 Boepd. While we are excited about the strong growth and the potential of our significant inventory position, we have turned our attention to managing the business in light of the current challenging market environment.”

2015 Projections

Citing lower commodity prices, Oasis Petroleum announced it will be reducing its 2015 capital spending by 12% over 2014 and expects the total to reach $705 million. Additionally, the company expects to complete 79 gross (63.3 net) operated wells and 2.6 net non-operated wells in 2015.

Read more at oasispetroleum.com