Emerald Oil announced its 2014 fourth quarter and year end financial results on Tuesday including huge increases for production and sales.

Fourth quarter production increased 7% over Q3 to average 4,101 BOEPD, with increases of 71% from the same time period in 2013. Throughout 2014, production increased 110% compared to 2013.

Related: Emerald Oil May Scale Back Bakken Drilling Program in Q1 2015

Emerald leadership attributes their strong position to the swift spending cuts made during the oil price freefall of the fourth quarter. Theses cuts and more streamlining will help them ride out a continued low price environment.

“McAndrew Rudisill, Emerald’s Chief Executive Officer, stated, “2014 was a year of tremendous reserve and production growth at Emerald Oil. We have made great strides in streamlining the efficiency of our entire Bakken production base through the diligent efforts of our operations team. We feel comfortable managing the current oil price environment for a prolonged period with our low cost balance sheet and substantial liquidity.”

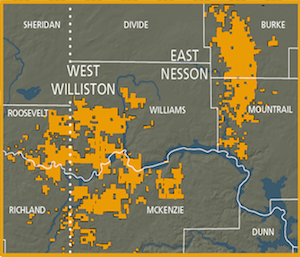

Revenues from sales of oil and natural gas for the fourth quarter were $22.1 million compared to $17.9 million in 2013. As of December 31, 2014, Emerald had total proved reserves of approximately 26.3 MMBoe, all of which were located in the Williston Basin.

Emerald’s operations primarily targets the Middle Bakken and Three Forks formations for its development drilling. The company holds approximately 125,000 net acres in the Williston Basin in North Dakota and Montana.

Related: Emerald Oil Acquires Bakken Acreage in the Williston Basin