Continental Resources appointed a new president and COO this week, following the reportedly unexpected resignation of Rick Bott last week.

Read more: Major Bakken Producer's President Quits - Continental Resources

The company provided few details when Bott left his position, other than he was leaving "to pursue other opportunities." Bott's replacement is Jack Stark, 59. Stark has been with Continental since 1992, and was formerly the company's Senior VP of Exploration.

Continental Stock Dips Slightly

In the midst of its leadership change, Continental also announced that it plans to increase its' portfolio-wide capital expenditures budget for 2014 to $4.55-billion ($2.85-billion in the Bakken). The reason for the increase has to do with Bakken well costs, which the company revealed this week are $10-million per well. That's more than $2-million per well, compared to the same time last year. This comes at at time when most operators in the area are reducing the well costs. According to Forbes, as a result of the higher than expected well costs, the company's stock dropped ~8% (about $5 per share) on Sept. 18th.

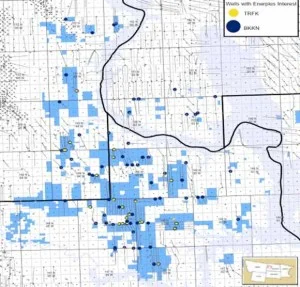

Continental is the largest oil producer in the Rockies, Bakken Shale play and the SCOOP play combined. It is the second largest producer in the Bakken, behind Whiting Petroleum, which just recently acquired Kodiak Oil & Gas.