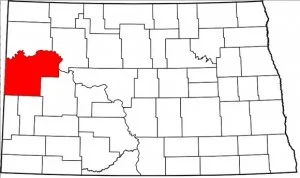

Bakken Resources Inc. sold 767 net acres in McKenzie County, ND to an undisclosed buyer in early February 2014.

Total purchase price for the acreage was $7,871,248. That comes out to $10,250 per net mineral acre.

Notable Bakken Acquisitions and Divestitures in January 2014

So far in 2014, there have been at least two other acreage deals in the Bakken.

Emerald Oil acquired 20,800 net acres in the Williston Basin for $74.6 million in two separate deals in early January.

Read more: Emerald Acquires Bakken Acreage in the Williston for $74.6 Million

Oasis had a $333 million sale in January of its’ non-operated Sanish properties and a few non-operated leases adjacent to the Sanish.

Read more: Oasis Sells Bakken Acreage - Strong Production Growth in 2014

Bakken Resources Gains ~412% Return on Investment

With the closing of its' acreage deal, Bakken Resources gains a ~412% percent return on its original investment. In November of 2010, the company spent $1,535,000 for the 767 net acres in McKenzie County.

Bakken Resources will retain a 2% royalty interest in the sold assets.

“We are very pleased about this win-win transaction,” notes Val Holms, CEO. “Proceeds from this transaction will allow us to seriously explore several other opportunities we are currently evaluating. We continue to hold a 2% royalty interest in the assets we sold and also receive royalties on our remaining 1,600 +/- net mineral acres located in Bakken region.”

Bakken Resources is a non-operator, and prior to this deal, the company owned mineral rights to approximately 7,200 gross acres and 2,400 net mineral acres of land in North Dakota.

Bakken Resources Acreage Deal Highlights

- 767 net mineral acres sold in McKenzie County, ND

- $10,250 per net mineral acre

- Total price for deal is $7,871,248

- ~412% increase on original investment of $1,535,000 in Nov. 2010

Read the full release: Bakken Resources Inc. Acreage Deal