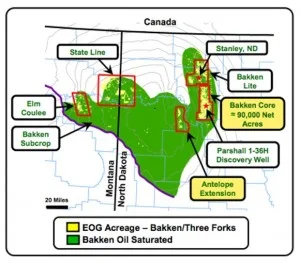

Centennial, CO-based Vitesse Energy, LLC has purchased non-operated oil and gas assets in the Williston Basin from EnerVest Operating, LLC for $186.5-million. Included in the deal are working interests in approximately 600 wells and over 19,000 net acres in core Bakken Counties of Williams, McKenzie and Mountrail.

“Vitesse CEO Bob Gerrity, said, “this acquisition represents a synergistic addition to our existing high-quality acreage in the core area of the Bakken and Three Forks play, and also provides new growth opportunities in developing areas of the field where technology continues to enhance returns.”

The agreement was signed on August 1st, and closed on September 8th. Vitesse Energy, LLC is a subsidiary of U.S.-based holding company Leucadia National Corporation.

Read more at vitesseoil.com