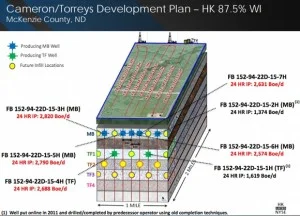

SM Energy plans to run three rigs spending $275 million on operated activity and another $75 million on non-operated properties.

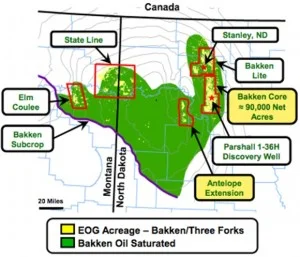

Activity will primarily target the Bear Den, Raven, and Gooseneck areas in North Dakota.

SM Energy expects to complete 45 gross, operated wells in 2014.

Tony Best, CEO commented, "Our 2014 growth will be anchored by our core development programs in the Eagle Ford and Bakken-Three Forks, with additional investments being made in our emerging oil programs in the Permian Shales and the Powder River Basin."

Read more at sm-energy.com