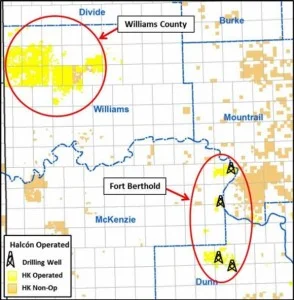

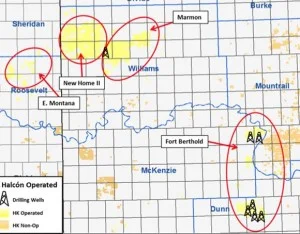

In a press release on January 8th, Halcón Resources executives announced that they will slash their drilling and production budget almost in half for 2015. The Houston-based company affirmed it will reduce operations in the Bakken to two rigs in the Fort Berthold area of North Dakota.

This is the second round of cuts for the Bakken producer in less than two months due to the continued decline in oil prices. Projected spending for the company is set at between $375 - 425 million, which represent a steep decline from 2014 numbers of $950 million. Even with decreased spending for 2015, production is expected to increase to an average 40,000-45,000 barrels per day, compared to 43,554 b/d in the third quarter of 2014.

“Halcon CEO Floyd Wilson says that, “Our plan is to deploy capital to assets where results indicate EURs and initial production rates higher than our published type curves. We are comfortable with our current liquidity position and we expect our strong hedge portfolio to continue generating income well into 2016. Although we are significantly hedged, the continued weakness in crude oil prices, combined with elevated service costs, calls for conservative planning. We expect to see these costs come down dramatically during 2015.”

Read the full report at halconresources.com.