EOG Resources is shifting to self-sourced sand for use in completions in the Bakken and Three Forks. The company has owned and operated sand mines supplying other plays for years.

EOG's sand mines will contribute to significant well cost savings.

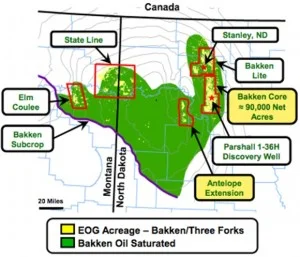

Most of the company's current activity is focused in the core area of the Parshall field and the company's Antelope Extension. EOG plans to complete 54 net wells in those areas in 2013.

“EOG is consistently making the best oil wells in the best two oil plays in North America, the Eagle Ford and Bakken/Three Forks.”

The company's utilization of more fluid and sand in completions is proving successful in the Bakken. The company has seen both improved recoveries and returns in the play.

EOG Bakken and Three Forks Well Highlights

- Six wells produced initial rates of approximately 2,000 b/d of oil or more in Mountrail County

- Three - Three Forks wells in the Antelope Area came online at rates between 1,235-2,100 b/d of oil

"Every quarter, EOG's technical understanding of the Eagle Ford and Bakken/Three Forks expands, as we further modify completion techniques that boost overall well productivity and economics," Thomas said.

EOG Increases Company-wide Production Growth Estimates

Production guidance in 2013 has been increased again. EOG expects 39% growth in oil production, 17% growth in NGL production and company-wide growth of 9%. That`s up from initial estimates of 28% crude oil growth, 10% NGL growth, and just 4% company-wide growth at the beginning of the year.