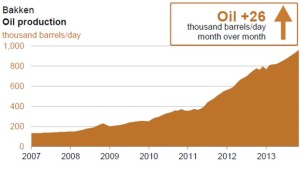

WPX Energy will spend between $1.420-$1.523 billion in 2014, with $580-600 million directed to Bakken and Three Forks targets in the Williston Basin.

WPX is planning to add a rig to bring its operated total to five in 2014.

The company expects the added rig will allow the company to drill 62 gross operated wells, or 25% more than the ~50 wells the company drilled in 2013.

Also read:Halcon Lowers Its 2014 Capital Budget & Holds Production Guidance

“Increased oil volumes, efficient development of our resource base and enhanced balance sheet flexibility will help drive increased cash flows and better overall results,” said Jim Bender, CEO.”

The emphasis in liquids producing areas will drive production growth in 2014. WPX expects daily oil production from the Williston and San Juan to increase ~50% from 16,000 b/d in the first quarter to more than 24,000 b/d by year-end.

In total, 85% of the company's capital budget is split between liquids producing plays in the Piceance, San Juan, and Williston basins.

WPX's capital budget:

- $580-600 million in the Williston Basin (oil)

- $475-495 million in the Piceance Basin (gas & ngls)

- $155-180 million in the San Juan Basin (oil)

- $20-30 million in the Appalachia region

- $10-15 million in legacy areas like the Powder River Basin

- $100-115 million on land and exploration

Read the full press release at wpxenergy.com