Calgary-based Baytex Energy appears to be on the verge of divesting some of its assets, and the company's Bakken assets may soon be on the auction block.

Recently, Baytex added 22,200 net contiguous acres in South Texas' Eagle Ford Shale through its $2.8 billion acquisition of Aurora Oil & Gas, which closed in June of 2014. Baytex officials say the company conducted a portfolio review of assets late in the second quarter in response to the Eagle Ford acquisition. During that process certain assets were earmarked for divestment, which officials say would be used to pay down debt.

Read more: Baytex Energy - Aurora Deal for Eagle Ford Assets - ~$2.6 Billion

Baytex has not disclosed any official word as to which assets, if any, may be divested from its portfolio. However, the Bakken assets may be a good candidate considering they make up only ~4% of the company's current production. According to analyst commentary in a recent Bloomberg article, Baytex could generate $375 million from the sale of its Bakken assets.

At the end of 2013, the company commissioned contingent resource assessments for some of its assets, including the Bakken. The results revealed the Bakken had the lowest number of contingent resources compared to some of the company's other assets.

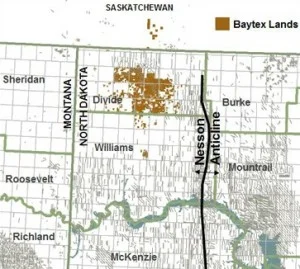

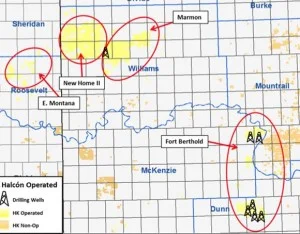

Baytex's Bakeen assets are located mostly in Divide County. By the end of 2014, the company plans to drill 15 (9.6 net) wells in the area.

Read more at baytexenergy.com