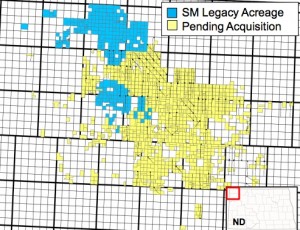

In late July of 2014, SM Energy announced it will acquire approximately 61,000 net acres in Divide and Williams Counties for $330-million from Baytex Energy. The acreage is directly adjacent to the company's Gooseneck focus area. Upon closing, the company will have ~97,000 acres in the area.

Company officials say the acquisition is expected to add significant drilling inventory, and includes interests in 126 drilling spacing units, 81 of which will be operated by SM Energy. Net production from the acreage is ~3,200 boe/d (91% oil, 1,500 BTU rich gas). The properties are 90% operated and approximately 70% held by production. Working interest for operated spacing units is expected to range between 37.5% – 50.0%

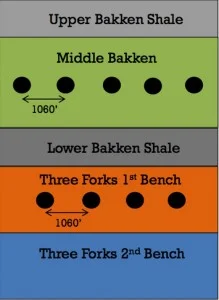

Directly adjacent to the acquisition area, SM Energy noted improvements in its Three Forks program recently due to faster drilling times and improved completions. Current data reflects recent wells have higher sustained production rates than older wells.

The transaction has an effective date of July 1, 2014, is expected to close by the end of the third quarter of 2014, and is subject to customary closing conditions and adjustments. The Company expects to fund the acquisition with cash on hand and borrowings under its existing credit facility.

Read more at sm-energy.com