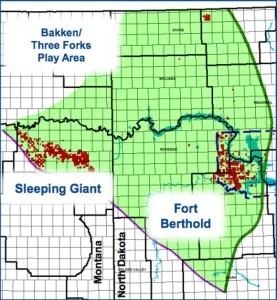

Approximately 40% of Enerplus's $760 million capital budget for 2014 will be dedicated to the Bakken and Three Forks. That's about $304 million.

The company expects to grow production by more than 30% in North Dakota in 2014.

Enerplus 2013 Capital Expenditures in Bakken

Read more: Enerplus Sets New Bakken Production Record in Q1

~$308 million of capital spending was in North Dakota, with the majority invested at Fort Berthold. Approximately 70% of company spending in 2013 was directed to crude oil assets.

“VP of Operations Raymond Daniels said, “45% of our capital spending was in North Dakota where we are targeting both the Bakken and Three Forks. Our focus was on driving improvements in capital efficiencies through a reduction in drilling costs and improvement in productivity.”

Capital spending came in slightly lower in 2013 than the original forecast of $685 million, totaling $681 million.

Enerplus Bakken Reserves

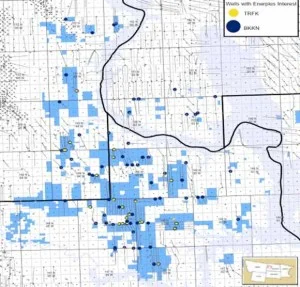

25 mmboe of 2P reserves were added in 2013 from North Dakota properties. The cost of this addition was $19.74 per boe including future development capital.

Total 2P reserves increased by more than 17% year-over-year, driven by additions in the Marcellus and Bakken/Three Forks properties.

Enerplus Bakken Initial Production Rates and Total Production

“According to VP of Operations, Raymond Daniels, “our two most recent Bakken wells have been completed using about a thousand tonnes of sand per lateral foot with roughly 40 frac stages. In their first 30 days these wells have produced a record of roughly 4,000 to 8,000 barrels of oil each.”

Enerplus total production grew in the fourth-quarter to 94,167 boe/d, which is up 7% from the third-quarter. Production for 2013 was 89,800 boe/d. That's up 9%.

Enerplus Highlights

- 40% of Enerplus's $760 million capital budget for 2014 will be dedicated to the Bakken and Three Forks - ~340 million

- Enerplus expects to grow production by more than 30% in North Dakota in 2014

- ~$308 million of capital spending was in North Dakota in 2013

- 25 mmboe of 2P reserves were added in 2013 from North Dakota properties

- Enerplus total production grew in the fourth-quarter to 94,167 boe/d

- Production for 2013 was 89,800 boe/d. That's up 9%

Read more at Enerplus.com