Halcón Resources Corporation announced this week that it plans to sell Bakken assets.

Halcón Resources Exits the Eagle Ford

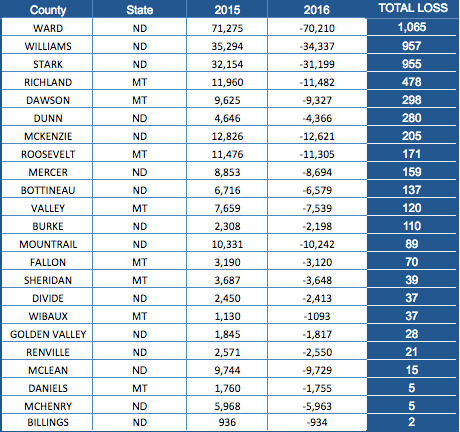

Houston-based Halcón will sell a major part of its North Dakota operations in order to shift focus to the Permian Basin. The sale included operated assets in the Williston Basin to an affiliate of Bruin E&P Partners for $1.4 billion

“The sale of our Williston Basin operated assets transforms Halcón into a single-basin company focused on the Delaware Basin where we have more than 41,000 net acres in Ward and Pecos Counties representing decades of highly economic drilling inventory. The cash proceeds from this transaction and related debt reduction provide us with a strong balance sheet and liquidity to execute our growth plans.”

Halcón shares jumped more than 35% at the news of the deal.

Halcón emerged from bankruptcy last fall, where it was able to eliminate approximately $1.8 billion in debt. Soon after, company executives announced it wouldl sell its Eagle Ford assets (“El Halcón”) to Hawkwood Energy for $500 million.