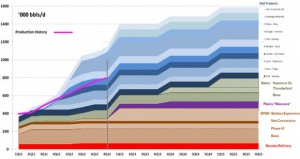

Bakken takeaway capacity is sufficient for the next couple of years, but production growth will lead to more pipelines in the long-term. Pipelines provide the cheapest and safest mode of transportation for oil. Current price differentials across the country allow operators to realize better netbacks by moving oil by rail to places where prices are better than say Cushing, Oklahoma, where WTI is priced. The price benefit outweighs the cost of moving crude by rail, so operators aren't pushing for more pipes at the moment.

Rail provided more than 60% of oil transportation out of the Williston Basin in early 2013. Approximately, 20 rail loading facilities have the capacity to move 700,000 b/d out of the region. A total of 583,000 b/d can be moved to refineries in the area or out of the basin by pipeline. Enbridge's Latest Bakken Pipeline Expansion brought pipeline capacity over 500,000 b/d by adding approximately 120,000 b/d of capacity into Canada.

With oil production estimated at 800,000 + b/d in the area, there is ample takeaway capacity - (~1.3 million b/d = 700,000 b/d of rail + 583,000 b/d of current pipeline and refinery capacity).

The Dakota Prairie Refinery will add an incremental 20,000 b/d demand when it is completed in 2015, bringing pipe and refinery capacity to more than 600,000 b/d.

Bakken Pipelines Canceled

Oneok canceled the Bakken Crude Express pipeline in the fourth quarter of 2012, but the main reason was a lack of interest. Interest waned as operators began realizing better prices by moving oil by rail. The pipeline would have delivered oil to Cushing, OK, and the best prices in the US simply aren't near Cushing. Operators are increasingly moving Bakken Crude to locations along the coasts where refineries are offsetting imports with Bakken crude. Prices closer to Brent ($110/bbl in early April), compared to WTI ($96/bbl), can be realized along the coasts.

Keystone XL, if it is ever approved, will add to the regions pipeline export capacity, but one of two things will need to happen if other pipelines are going to be built:

- WTI prices need to improve in comparison to world benchmarks, so pipelines south become attractive or

- Production will need to grow to a level that supports a large, long distance pipeline that bypasses Oklahoma for better prices elsewhere

The future of pipelines out of the basin will be a fun story to follow. If production continues a growth trajectory like we saw in 2012, it's not a question of will more pipelines be built, but when will they be built.