Enable Midstream (ENBL) has filed for an initial public offering and expects to raise net proceeds of $500 million to be used in expansion projects. The company will trade as a master limited partnership (MLP).

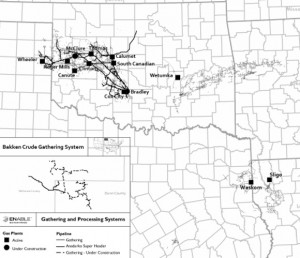

The deal includes Bakken gathering assets that were contributed by CenterPoint Energy.

The gathering system commenced operations in November 2013 and is expected to be in full operation in the third quarter of 2014. Enable Midstream estimates it could spend as much as $110 million on the Bakken system.

The company's Bakken system will have capacity of 19,500 b/d when fully operational and that entire amount is contracted through 2028. While only partially in service for most of the year, Enable estimates it will gather a little less than 10,000 b/d in 2014.

The company was formed in May of 2013 by affiliates of CenterPoint Energy, OGE Energy and ArcLight Capital Partners. The assets include CenterPoint's interstate pipelines and field services, as well as OGE's midstream business.

Enable Midstream is managed by a general partner whose governance is shared by CenterPoint Energy and OGE Energy on a 50/50 basis.

About Enable Midstream

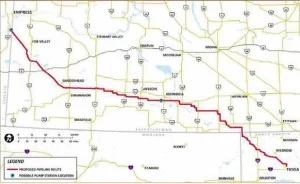

Enable Midstream owns, operates and develops strategically located natural gas and crude oil infrastructure assets. Enable Midstream's initial assets include approximately 11,000 miles of gathering pipelines, 11 major processing plants with approximately 1.9 billion cubic feet per day of processing capacity, approximately 7,800 miles of interstate pipelines, approximately 2,300 miles of intrastate pipelines and eight storage facilities comprising 86.5 billion cubic feet of storage capacity.

Read the full press release at oge.com