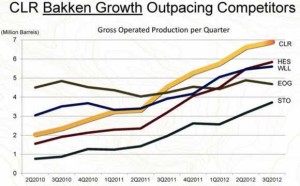

Continental Resources Bakken assets account for 86% of the company's provded undeveloped (PUD) reserves. That's important because the company just reported proved reserves growth of 54%, an increase from 564 mmboe to 785 mmboe. Over 200 mmboe were added through exploration and development activity and over 80 mmboe were added through acquisitions.

Continental's (CLR) reserves have grown an average of 45% each year since 2009. If that trend continues, Continental will book more than 1.1 BILLION boe at the end of 2013!

"We continue to increase our concentration in high-value, high-growth, crude oil assets, especially in the Bakken," said Harold Hamm, Chairman and Chief Executive Officer. "We are growing the value of our Bakken assets through strategic acquisitions, exploration, and the expanded use of pad drilling, which should improve efficiencies and translate into even better rates of return."

Other items of note from the company's reserves press release include:

- 39% of CLR's proved reserves are proved, developed and producing (PDP)

- Crude oil accounts for 72% of reserves (up from 64% at year-end 2011)

- CLR operates 85% of its proved reserves

- Increased the company's Bakken position by 24% in 2012 (~900,000 acres to >1.1 million acres)

- Total of 1,763 gross (982 net) PUD locations (86% Bakken)

- First reserve bookings from the lower benches of the Bakken-Three Forks

If oil prices hold strong, it looks like 2013 will be another great year for Continental.