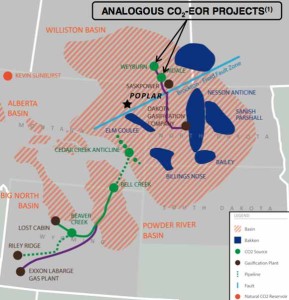

Magellan Petroleum is planning a five well CO2 pilot test at its Poplar Field in northern Montana. The price tag for the test is estimated at $20 milllion.

Evaluation of the project is expected to take any where from one to two years. From there, Magellan hopes to take the field into full development.

Five wells will be used during the test - one injection well and four producing wells.

Magellan hopes full scale development could yield as much as 50 million barrels of oil. The field is unitized and consists of 22,000 acres.

“We believe that bringing this field to full-scale EOR development could result in the addition of 50 million barrels of reserves to our books and could have a significant multiplier effect on our valuation.”