Oasis Petroleum's Bakken production held relatively flat at an average of 30,171 boe/d in the second quarter, but expect as much as 10% in the third quarter as more wells are brought online.

The company's inventory of wells drilled and not yet completed swelled to 37 in the quarter, but that number will shrink in the next few months. Oasis is expected to complete 40-45 wells in the third quarter after completing just 51 wells in the first half of the year.

“We completed 20 gross operated wells with an average working interest of 70%, which is in line with what we projected. This allowed us to keep production relatively flat quarter over quarter. We completed 14.7 net operated and non-operated wells in the second quarter of 2013, while our backlog of wells waiting on completion grew significantly as we began pad drilling during the quarter.”

Operated well costs in the Bakken have fallen to $8.2 million or approximately $7.8 million when accounting for savings realized through Oasis Well Services. The company is now running 11 rigs in the region and expects to realize additional savings as operations turn to pad drilling.

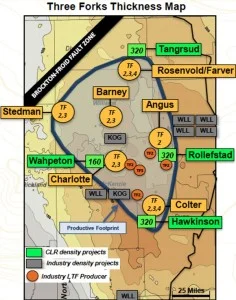

Watch for results from two Lower Three Forks wells being drilled in the Indian Hills and North Cottonwood areas. The company's assessment of the play will be completed by year-end and you can expect to see Lower Three Forks wells in the 2014 development plans.