The Bakken rig count held flat at 181 rigs running over the past week. This marks the last full week of September and the rig count in the Bakken region has averaged a little more than 185 rigs running over the first nine months of the year.

Not all rigs counted in our census are drilling for the Bakken, but it's close. The NDIC estimates 95% of activity in this region targets the Bakken and Three Forks formations.

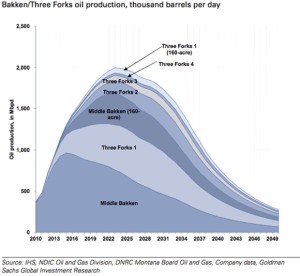

There were several notable comments related to production this week. Goldman Sachs visited North Dakota and believes production will grow by more than 130,000 b/d each year through 2016. Lynn Helms, the director of the ND Department of Mineral Resources, stated his belief that production will double by 2017. Production growth will only be possible if the proper transportation options are available. Earlier this week, Allete announced plans to use a power line right-of-way that stretches from Center, ND, to Duluth, MN, to establish an energy corridor. Read more in the article: Bakken Oil & Gas Might Follow Allete's Transmission Line Right-of-Way

The U.S. rig count increased 13 rigs from 1,761 to 1,774 running over the past week. A total of 376 rigs are targeting natural gas (10 less than last week) and 1,362 are targeting oil in the U.S. The remainder are drilling service wells (e.g. disposal wells, injection wells, etc.).183 rigs, or one less than last week, are running in the Williston Basin

Note: The NDIC reports 184 rigs are active in North Dakota. That is 14 more than Baker Hughes reports. The difference is likely accounted for in the number of rigs actually working and rigs that might not be serviced by Baker Hughes. On any given week, a certain number of rigs are in route to the next well location or idle waiting to drill the next well. The NDIC notes that more than 10 rigs are in the process of moving in and rigging up.

Bakken Oil & Gas Rigs

[ic-l]The number of oil rigs running held flat at 181 in the region. WTI oil prices fell further during the week and oil was trading near $103/bbl on Friday. The commodity has held above $100/bbl for 12 weeks now. Williston Basin Sweet crude traded at $90.69/bbl on Sept 26th.

The natural gas rig count in the region held flat at zero. Natural gas futures (Henry Hub) were trading near $3.50/mmbtu on Friday. Natural gas delivered to the Northern Border pipeline in Watford City is trading near $3/mmbtu. A little more than 10% of the production stream from the Bakken and Three Forks is attributable to natural gas.

McKenzie County led development with 63 rigs running. Dunn, Mountrail, and Williams counties are the only other counties with more than 20 rigs running. View the full list below.

Activity is dominated by horizontal drilling: 159 rigs are drilling horizontal wells, 16 rigs are drilling directional wells, and six rigs are drilling vertical wells.

Bakken Oil & Gas News:

Be sure to visit our Bakken Job Listings to search openings and come back weekly for updates.

Bakken Drilling by County