Kodiak Oil & Gas' 2014 capital budget has been set at $940 million. That's down from approximately $1 billion in 2013.

Kodiak expects to spend $890 million drilling and completing ~100 net wells to production 45%.

$50 million is budgeted for infrastructure build-out and acreage acquisitions.

Kodiak has budgeted for seven operated rigs and a dedicated frack crew in 2014. An additional completion crew will be on standby and utilized on an as needed basis.

Production in 2013 is on pace to average 29,000 boe/d and the company believes 2014 production will average 42,000-44,000 boe/d. Kodiak currently has over 26,000 b/d locked in with hedges at $93.29/bbl in 2014.

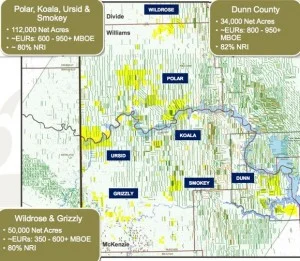

Polar & Smokey Downspacing Results Look Promising

[ic-r]Two 12-well downspacing tests have yielded promising results. The 12 wells completed in the Polar area have averaged 618 boe/d over the first 120 days and the 12 wells in the Smokey area have averaged 627 boe/d over the first 60 days.

Kodiak estimates the Polar area downspacing unit is on pace to pay out in as little as 18 months.