Halcon Resources ran seven rigs and spud 16 wells in the Bakken during the second quarter. A total of ten wells were brought online and new completion methods are proving successful. The average well completed in the Fort Berthold area had an average initial production (IP) rate of more than 2,000 boe/d. Completion rates improved by more than 50% across the area in the quarter.

The two most recent completions came online at more than 3,000 boe/d and a company record was set with an IP of 3,317 boe/d.

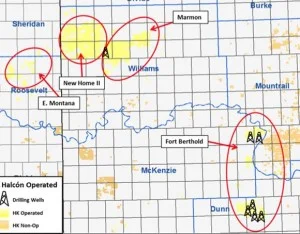

Halcon has 150,000 net acres in the Williston and plans to run six rigs through the remainder of the year. The company has 149 Bakken & Three Forks wells producing, 18 wells being completed, and seven wells being drilled.

Halcon expects downspacing tests to provide more details related to effective drainage of the Bakken and Three Forks. The company is also testing the application of slick water fracks across areas of its holdings. Tests are ongoing through 2013.

The company also published higher than expected operating costs due to weather and associated delays in North Dakota during the quarter.

You can read the company's full press release at halconresources.com