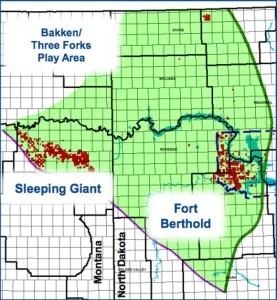

EOG Resources opened North Dakota to the modern oil industry when the company discovered the Parshall Field in 2006. The company led the shift to horizontal drilling and hydraulic fracturing in oil plays like the Bakken and Eagle Ford. Forbes published an interesting article on the company in July.

EOG invested in areas that weren't common for oil companies just a few years ago.

- EOG spent $100 million on a rail terminal in 2008

- EOG invested $200 million in three sand mines and two processing facilities in Wisconsin

EOG increased the value of oil the company was producing by bypassing pipeline choke points.

Sand mines in Wisconsin save the company an average of $500,000 per well. Self-sourced sand saves the company as much as $300 million per year!

In addition, EOG is using microseismic sensors to understand the reach and effectiveness of the company's well completions. As a result, the company has shifted from focusing on reach in completions to utilizing shorter, but more energy intensive fracks. Shorter frack lengths allow the company to drill wells at closer acreage spacing.

Read the full article at forbes.com