Whiting Petroleum had record production in 2013 of 94,090 boe/d across its portfolio. That's up 14% from 2012 production of 82,540 boe/d.

In the fourth-quarter of 2013, Whiting's production hit the 100,000 boe/d mark. That's up 9% from the third-quarter.

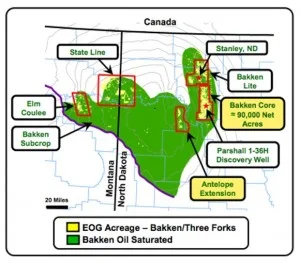

The strong production numbers are due largely to the company's development of core Bakken assets in North Dakota and Montana.

Read more: Whiting Expands Bakken Position and Tests New Completion Designs in the Third Quarter

“Whiting CEO, James Volkner, said, “with full-scale development underway at such fields as Pronghorn, Hidden Bench and Missouri Breaks, we generated excellent results in 2013. In the wake of this development, we posted records in production, proved reserves and discretionary cash flow.”

Whiting Petroleum's Bakken & Three Forks Fourth-Quarter Production

Whiting's fourth-quarter production was up across its core Bakken North Dakota and Montana assets. Production numbers for the fourth-quarter are as follows:

- Western Williston Basin - 17,790 boe/d

- Southern Williston Basin - 15,065 boe/d

- Sanish Field - net production of 40,370 boe/d

Whiting's Western Williston Basin Highlights - 2013

Whiting's Western Williston Basin assets are comprised of the Hidden Bench, Tarpon, Missouri Breaks and Cassandra fields. These areas represent a total of 204,198 gross (121,909 net) acres.

Production was up 30% for Whiting's Western Williston Basin assets from the third-quarter total of 13,710 boe/d. Among all of Whitings assets, this is the largest production increase quarter-over-quarter.

In the Hidden Bench Field, Whiting tested its new completion design, which utilizes cemented liners. Two wells in this field where the completion design was applied yielded an average of ~1,320 boe/d per well. According to the company, wells completed using the new completion design had average initial production (IP) rates 53% better than wells completed with Whiting's previous completion design.

Whiting's Southern Williston Basin and Sanish Field Highlights - 2013

Whiting's Southern Williston Basin assets include the Pronghorn and Lewis & Clark fields. These areas represent 392,483 gross (263,376 net) acres. Production was up 6% in the fourth-quarter 2013 from third-quarter 2013 production of 14,610 boe/d.

In the Sanish, average net production in the fourth-quarter increased 10% from third-quarter production of 36,840 boe/d. Two infill wells, testing an eight-well testing pattern, yielded an average of ~1,350 boe/d per well. These wells were completed using the company's new completion design.

Read more at whiting.com