An Irish correspondent visited North Dakota and he believes the Bakken boom is getting boomier. It's a good overview of what's happening from a foreign perspective. Enjoy the Irish commentary:

A few interesting quotes and takeaways:

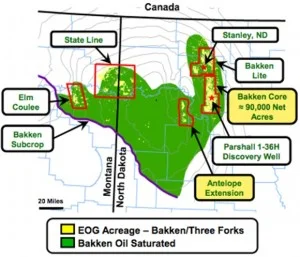

- The Bakken covers an area twice the size of Ireland

- The population in the region is just half that of the Irish Province Munster

- Development is the "biggest oil boom on American land since Texas"

- "Digging" thousands of oil wells

- Prices are making the boom even more boomier

- Lucky workers make it to the man camps that beat all man camps

- Many didn't have much and are now multi-millionaires

P.S. Don't be surprised if you see me use the word "boomier" (pronounced: boomy-er) in the future.