Marathon Oil's Bakken production held flat at 38,000 boe/d in the third quarter as the company shut in production to complete adjacent wells. Compared to the third quarter of 2012, production is up 27%.

Flat production from one quarter to the next isn't a knock on Marathon, it's going to happen with the expanded use of pad drilling. Unless operators stagger their pad drilling perfectly (near impossible), we'll see lumpy production additions going forward.

“Marathon Oil achieved strong financial results in the third quarter, delivering $1.44 billion in operating cash flows before working capital changes, and adjusted net income of $617 million, 29 percent higher than the second quarter,” said Lee M. Tillman, CEO. “All three business segments performed well, capturing the higher liquid hydrocarbon realizations both domestically and internationally, compared to the second quarter.”

Marathon hit total depth on 21 gross wells and brought 21 gross wells to production during the quarter. The 2013 exit rate for production is estimated at 40,000 boe/d.

The company's average drilling time for each well fell from 15 days in the second quarter to 14 days in the third quarter. That's 20% faster than one year ago.

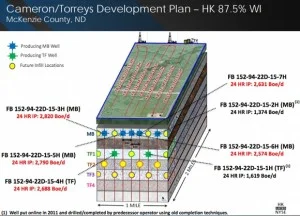

Marathon also discussed successful results in the Three Forks. The company is targeting the upper portion of the play and expects to explore the lower benches in 2014. Marathon has drilled 58 Three Forks wells to date and the formation accounts for more than 20% of the company's production in the region.

Read the full release at marathonoil.com