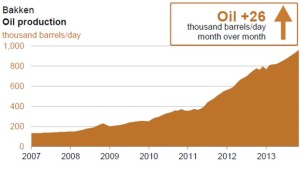

The Bakken rig count increased by two rigs to 176 running last week.

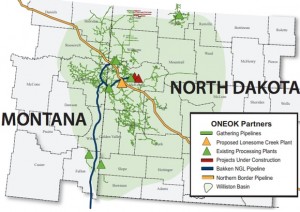

News was highlighted by an announcement from Oneok that the company willspend an additional ~$650-780 million expanding midstream infrastructure in the region. Oneok plans to expand its' Bakken NGL Pipeline, add gathering and compression, and build a seventh NGL processing plant (its largest to date). Read more in the article: Oneok Investing More In Bakken Midstream Infrastructure

The U.S. rig count decreased 1 rig from 1,762 to 1,761 running over the past week. A total of 369 rigs are targeting natural gas (1 less than last week) and 1,387 (2 more than last week) are targeting oil in the U.S. The remainder are drilling service wells (e.g. disposal wells, injection wells, etc.). 179 (up 2 from last week) rigs are running in the Williston Basin across MT, ND, and SD.

Not all rigs counted in our census are drilling for the Bakken, but it's close. The NDIC estimates 95% or more of activity in this region targets the Bakken and Three Forks formations.

Note: The NDIC reports 187 rigs are active in North Dakota. That is 21 more than Baker Hughes reports in the Bakken area. The difference is likely accounted for in the number of rigs actually working, rigs that might not be serviced by Baker Hughes AND areas outside of the Bakken fairway. On any given week, a certain number of rigs are in route to the next well location or idle waiting to drill the next well. The NDIC notes that more than 10 rigs are in the process of moving in and rigging up.

Bakken Oil & Gas Rigs

[ic-l]The number of oil rigs running increased by two to 176. WTI oil prices were trading near $95/bbl to end the week. Williston Basin Sweet crude traded at $76.44/bbl as of Nov 22nd. The WTI-Brent spread continues to widen, widening to over $15 as of Nov 18, which should continue to spur the growth of crude by rail.

The natural gas rig count in the region held flat at zero. Natural gas futures (Henry Hub) were trading near $3.75/mmbtu on Friday. Natural gas delivered to the Northern Border pipeline in Watford City is trading near $3.00/mmbtu. A little more than 10% of the production stream from the Bakken and Three Forks is attributable to natural gas

McKenzie County continues to lead development with 60 rigs running. Dunn, Mountrail, and Williams counties are the only other counties with more than 20 rigs running. View the full list below.

Activity is dominated by horizontal drilling: 155 rigs are drilling horizontal wells, 15 rigs are drilling directional wells, and 6 rigs are drilling vertical wells.

Bakken Oil & Gas News

Be sure to visit our Bakken Job Listings to search openings and come back weekly for updates.

Bakken Drilling by County